An externality can only exist if an activity controlled by one agent has an impact on the well-being of another agent or set of agents. When the impact of one economic agent on another is not considered by typical market behavior, an externality occurs in these circumstances. Different people have defined externalities in different ways and according to Sigali and Balsari (2018), an externality is a loss or gain in the welfare of another party as a result of one party’s activity. The aggrieved party shall not be entitled to any compensation.

Externalities are mainly 2 parts. That is, as positive externalities and negative externalities. Positive externalities are again divided into two parts. That are positive externalities of production and positive externalities of consumption. Also, negative externalities are again divided into two parts. That is, as negative externalities of production and negative externalities of consumption (Kenton, 2022).

Source: https://twitter.com/AzCouncilEconEd/status/1598362633186545664

Positive externality is an indirect benefit that an unrelated third party receives as a result of a production or consumption activity of one party. In that case, positive externalities occur because the social benefits from producing or consuming goods are greater than the private benefits of third parties.

A negative externality is an indirect cost incurred by an unrelated third party from the production or consumption of a party’s good. Here a negative externality occurs as the social cost of the negative party is greater than the private cost.

Market failure occurs due to externalities (Sigali and Balsari, 2018). Market failure can be defined as the inefficient allocation of goods and services in the free market (Boyle, 2023). In a market that functions optimally, supply and demand factors are balanced, and any changes to one side of the equation result in price changes that preserve the market’s equilibrium. However, in a market failure, something disturbs this balance. In particular, failure to address negative externalities and failure to encourage positive externalities results in market failure. Accordingly, market failure due to externalities can be discussed as follows.

Negative externalities of production and market failure

Negative externalities of production are the costs incurred by one party in producing a good or service for an unrelated third party. These costs are not reflected in the market price of the product and are borne by society as a whole. In this situation, market failure occurs because resources fail to be efficiently distributed through the market mechanism (Pettinger, 2019).

Negative production externalities can take various forms. For example, consider a factory that produces goods but also emits pollutants into the surrounding environment. The pollution generated by the factory may harm nearby residents’ health, reduce air or water quality, and negatively impact ecosystems. These costs, such as healthcare expenses or the loss of biodiversity, are not borne by the factory but by the affected individuals or society at large (CFI Team, 2019).

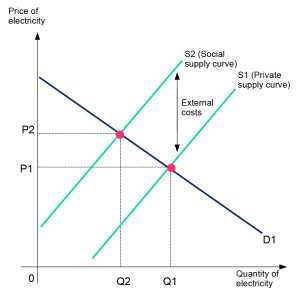

For example, Pollution emitted into the atmosphere as a result of the company’s production process is one example of a negative production externality. For instance, a company that produces power pollutes the environment. The pollution produced by the firm is an external cost to individuals. This is due to the price consumers pay not accurately reflecting the full expenses, which can include health issues and a dirty environment. Only the production costs are reflected in the pricing. Electrical underpricing stimulates excessive consumption, which leads to excessive electrical output and pollution.

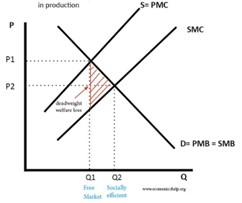

Figure 1 provides an illustration of this circumstance. The supply curve S1 depicts the negative production externalities brought on by excessive power production and consumption because the price P1 is only set in the account of private costs and benefits. As a result, Q1 is consumed in quantity, and only private equilibrium is reached.

The S2 supply curve, on the other hand, indicates the price P2 set considering the social costs and benefits. This is indicative of Q2’s lower consumption, and it promotes achieving social equilibrium.

Figure 1: Negative externalities of production and market failure

A market failure occurs when the factory produces the goods because the market price of the goods does not include the costs associated with pollution. As a result, the quantity of goods produced in the market may exceed the socially optimal level. The market fails to account for the negative external costs imposed on society, which leads to overproduction and inefficient allocation of resources.

When there are negative production externalities, the societal cost of production is greater than the producer’s private cost. Private and social gains also diverge as a result of the disparity between private and social costs. Consequently, the market equilibrium fails to maximize overall social welfare.

To address market failures caused by negative production externalities, various policy interventions can be implemented. One approach is the imposition of government regulations or taxes on polluting activities to internalize external costs. For instance, the government may enforce emissions standards or impose a tax on each unit of pollution emitted. These measures aim to align private costs with social costs, providing economic incentives for producers to reduce pollution and produce at a socially optimal level (MasterClass, 2022).

Another approach is the implementation of market-based mechanisms such as tradable pollution permits or cap-and-trade systems. These systems set a limit on the total amount of pollution allowed and allocate permits to firms accordingly. Firms can then trade these permits, creating a market for pollution rights. This approach encourages pollution reduction by rewarding firms that can reduce emissions at a lower cost.

By internalizing the negative production externalities, these interventions help correct market failures and ensure a more efficient allocation of resources that aligns with societal welfare.

Negative externalities of consumption and market failure

Negative consumption externalities refer to the costs or negative effects imposed on third parties who are not involved in a transaction or economic activity. These externalities arise when the consumption of a good or service by one individual or group imposes costs on others in society (Ahmad,2020). The costs can be in the form of environmental damage, health hazards, or reduced quality of life.

Market failure occurs when the market mechanism, which is based on supply and demand, fails to efficiently allocate resources and produce the optimal outcome for society. Negative consumption externalities are one of the main causes of market failure.

When negative consumption externalities exist, the price of a good or service does not reflect the full social costs associated with its consumption. The private cost, which is borne by the consumer, is lower than the social cost, which includes the additional costs imposed on society as a whole. As a result, the price of the good or service is lower than it should be, leading to overconsumption. It causes market failure.

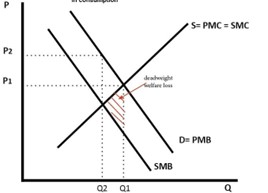

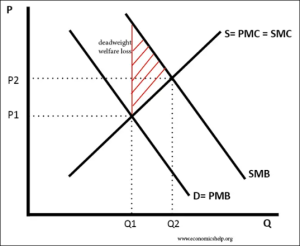

Figure 2: Negative externalities of consumption and market failure

Source: https://www.economicshelp.org/micro-economic-essays/marketfailure/negative-externality/

In a free market, Q1 is the output. But at this output, the social marginal cost is greater than the social marginal benefit. The area of dead-weight welfare loss is indicated by the red triangle. When the social marginal benefit equals the social marginal cost, social efficiency occurs at a lower output (Q2).

Consider the consumption of fossil fuels like coal, oil, and gas as an example. When individuals or businesses burn these fuels for energy, they release greenhouse gases and contribute to climate change. The costs of climate change, such as extreme weather events and damage to ecosystems, are borne by society as a whole. However, the price of fossil fuels does not include these costs, leading to overconsumption and an inefficient allocation of resources (CFI Team, 2019).

Negative consumption externalities can also lead to a misallocation of resources. Since the private cost is lower than the social cost, individuals or businesses have an incentive to consume more of the good or service than is socially desirable. This results in an overproduction of goods with negative externalities and an underproduction of goods with positive externalities, such as education or public transportation.

Governments often step in to alleviate negative consumer externalities and market dysfunction through regulation, taxes, or the provision of public goods. For example, governments may impose taxes on goods or activities that generate negative externalities, such as carbon taxes on greenhouse gas emissions. The revenue generated from these taxes can be used to offset the social costs or invest in alternative, more sustainable technologies. Governments may correct market failures and promote more efficient and sustainable consumption habits by internalizing external costs and changing pricing to reflect the full societal costs.

Positive externalities of production and market failure

Positive production externalities refer to the benefits or positive effects that are experienced by third parties as a result of production activity. These externalities arise when the production of a good or service by one individual or firm generates benefits for others in society. The benefits can be in the form of improved infrastructure, knowledge spillovers, or enhanced public health (Kenton,2021).

In a considered economy When positive production externalities exist, the price of a good or service does not fully reflect the social benefits associated with its production. The private benefit, which is captured by the producer, is lower than the social benefit, which includes the additional benefits enjoyed by society as a whole. As a result, the price of the good or service is higher than it should be, leading to underproduction.

Figure 3: Positive externalities of production and market failure

Source: https://www.economicshelp.org/micro-economic-essays/marketfailure/positive-externality/

Because there are positive externalities in production, the social marginal cost of production is less than the private marginal cost of production. In a free market, a firm will ignore benefits to third parties and will produce at Q1 (free market outcome). However, the socially efficient level will be at Q2 (where social marginal cost = social marginal benefit).

As an example, considering the product of education, when individuals or institutions invest in education, it not only benefits individuals but also has a positive impact on society. A more educated population can lead to higher productivity, improved innovation, and a healthier workforce. However, the private returns to education, such as higher wages for individuals, do not fully capture the social benefits. As a result, there may be underinvestment in education from a societal perspective (Kenton,2021).

Positive production externalities can also lead to a misallocation of resources. Since the private benefit is lower than the social benefit, producers have less incentive to engage in activities that generate positive externalities. This results in the underproduction of goods or services with positive externalities, such as research and development, public infrastructure, or environmental conservation.

Governments can intervene to reduce market failures caused by positive production externalities and encourage the generation of positive externalities. This can be done through subsidies, grants, or public investments in areas that generate positive spillover effects. For example, governments may provide grants to support scientific research or invest in infrastructure projects that benefit multiple stakeholders. By internalizing the external benefits and adjusting prices or providing incentives, governments can correct market failures and promote the production of goods and services that generate positive externalities.

Positive externalities of consumption and market failure

Positive consumption externalities refer to the benefits or positive effects that are enjoyed by third parties as a result of the consumption of a good or service. These externalities arise when the consumption of a good or service by one individual or group generates benefits for others in society. The benefits can be in the form of increased social interactions, cultural enrichment, or improved public health (Kenton,2022).

Market failure occurs when the market mechanism fails to properly account for and incentivize the generation of positive consumption externalities, leading to an inefficient allocation of resources and suboptimal outcomes for society. When positive consumption externalities exist, the price of a good or service does not fully reflect the social benefits associated with its consumption. The private benefit, which is enjoyed by the consumer, is lower than the social benefit, which includes the additional benefits enjoyed by others in society. As a result, the price of the good or service is higher than it should be, leading to underconsumption.

Figure 4: Positive externalities of consumption and market failure

Source: https://www.economicshelp.org/micro-economic-essays/marketfailure/positive-externality/

In this case, the social marginal benefit of consumption is greater than the private marginal benefit. In a free market, consumption will be at Q1 because demand = supply (private benefit = private cost). However, this is socially inefficient because at Q1, social marginal cost < social marginal benefit. Therefore, there is an under-consumption of the positive externality. Social efficiency would occur in Q2 where social cost = social benefit

For example, consider the consumption of vaccines. When individuals or communities get vaccinated, not only do they protect themselves from infectious diseases, but they also contribute to broader public health by reducing the transmission of diseases to others. This creates positive externalities by reducing the overall disease burden and improving public health outcomes. However, the private benefit of vaccination, such as personal immunity, does not fully capture the social benefits. As a result, there may be underconsumption of vaccines from a societal perspective (Kenton,2022).

Positive Consumption externalities can occur due to the misallocation of resources. Since the private benefit is lower than the social benefit, consumers have less incentive to engage in activities that generate positive externalities. This results in underconsumption of goods or services with positive externalities, such as education, cultural activities, or environmental conservation.

Market failures can be mitigated through government intervention to encourage the consumption of goods and services that generate positive externalities. This can be done through subsidies, public campaigns, or the provision of public goods. For example, governments may subsidize the cost of education to encourage greater access and participation. They may also invest in public parks or cultural institutions to promote cultural enrichment and community well-being. Also, by internalizing externalities and providing price adjustments or incentives, governments can correct market failures and promote the consumption of goods and services that produce positive externalities.

M.M.S.A. Karunarathna and N.M.A.Jayasinghe

Department of economics

Faculty of Humanities and Social Sciences

References

Ahmad, D.B 2020, ‘Negative externalities of consumption: Examining the effects of the Norwegian policy on standardised snus packaging’.

CFI Team 2019, Negative Externalities, Available from: https://corporatefinanceinstitute.com/resources/economics/negative-externalities/ [13 June 2023].

Externalities, Available from: https://www.studysmarter.co.uk/explanations/microeconomics/market-efficiency/externalities/#:~:text=There%20are%20four%20main%20types,negative%20production%2C%20and%20negative%20consumption.ource [18 June 2023].

Kenton, W 2021, Production Externality: Definition, Measuring, and Examples, Available from: https://www.investopedia.com/terms/e/externality-of-production.asp [13 June 2023].

Kenton, W 2022, Externality: What It Means in Economics, With Positive and Negative Examples, Available from: https://www.investopedia.com/terms/e/externality-of-production.asp [14 June 2023].

MasterClass, 2022, What Are Externalities? How to Reduce Negative Externalities, Available from: https://www.masterclass.com/articles/externalities [14 June 2023].

Pettinger, T 2019, Negative Externalities, Available from: https://www.economicshelp.org/micro-economic-essays/marketfailure/negative-externality/ [19 June 2023].

Sigali, S & Balsari, K 2018, ‘Theoretical Insights on Integrated Reporting and Externalities’, Muhasebe Bilim Dünyası Dergisi, pp.859-869.

Zilberman, D 1999, ‘Externalities, Market Failure, and Government Policy’.